Japan has been in the year 2000 for the past 50 years.

Not the first time I see this, still makes me laugh

Cash is king, we shouldn’t be paying MasterCard and VISA for every purchase we make.

Case in point: when the UK left the EU, MC and VISA immediately increased their transaction fees from 0.3% to 1.5%.

Cash isn’t much use for making purchases online, which is also where an ever increasing amount of spending is done.

There’s no coin or note slot on my laptop, and contrary to the internet’s advice throwing money at my screen doesn’t seem to work either.

I used to be a big proponent of cash but with the bulk of my financial activity happening online now I can’t help it feeling a bit redundant.

Cash is needed nonetheless because when there is a downtime for whatever reason, it is not good if the only thing you have is a card.

Mullvad lets you mail them cash, but I don’t think it’s scalable nor fast enough to be widely used.

The last time I sent cash in the mail was in the early 00s when buying CDs from ebay. Wild that there is a service today that takes cash via mail.

They do it to make it as anonymous as possible

Retaining some ability to spend and use cash is vital because otherwise, all our financial transactions are totally controlled by the banks, and they are completely untrustworthy. The cost is inconvenience.

Yes that’s fair enough, cash doesn’t work online - but bitcoin is a better solution for online transactions than cards.

I mean, we haven’t even got into the subject of data tracking. If you think Facebook is bad, consider for a moment how much your card provider knows about you. Banks and card companies have learned from Facebook, and data brokerage is now a trillion dollar industry - with only 8 billion people in the world (many of whom don’t use the internet or have data being traded), that means your data is worth roughly $1,000 a year. Surely, as the manufacturer of the data, you should be getting some of that?!

Lol Bitcoin is not better than cards for online shopping, the only thing it’s better for is buying whatever you’re smoking.

Objectively, bitcoin is better for online transactions. It’s not even all that safe for buying drugs - every transaction is recorded permanently in an open ledger, so it’s actually much easier to trace (at least up to the end points where traditional currency is exchanged).

It might be less widely accepted, but that’s only because of how insidiously endemic MasterCard and VISA are.

How is bitcoin objectively better? That’s a pretty bold statement that needs some backing arguments.

They both have pros and cons, but until BTC have garanteed near instanteneous transaction confirmation, I don’t see how that would work at the grocery store for example.

Bitcoin is objectively better based on the way it works. Subjectively, with the established infrastructure behind it, traditional card payments are artificially better - purely because of convenience. But on a level playing field bitcoin works better and is less susceptible to negative influences.

The grocery store is not typically an online transaction. I did specify online transactions. For buying groceries online, bitcoin would be better - there are no fees when trading bitcoin. When trading cash, there are no fees.

When putting cash into a business account, there are fees, and as almost all businesses put their money into an account they pay these fees. These cash deposit fees and card processing fees have grown in such a way as to entrap nearly all commercial transactions.

Objectively, it’s better if there aren’t fees, particularly when the fees are not proportional to the actual service the fees are supposed to represent.

That’s a weird take. A system is better because it’s free?

I re-read your comment and I missed the fact that you said online buying, sorry about that.

One advantage of traditional CC over Bitcoin is buyer insurance against fraud. If someone gets a hold of your Bitcoin wallet, he can take out everything and you have no recourse.

If someone steal your credit card and make fraudulent purchases, the transactions will be cancelled and you won’t be left on the hook.

bitcoin is a better solution for online transactions than cards.

Aaaaaand now you’ve lost me.

Aaaaand how?

For one, Bitcoin is inefficient and energy intensive technology.

Just saw a sign in my bakery today begging people to pay by card because getting small coins from the bank is hard and expensive.

TBF here in Belgium Bancontact has a local monopoly (about 1 % flat fee, no fixed cost per transaction; that seems fair and intuitively cheaper than holding, insuring, depositing cash, dealing with employees skimming off the top, of the time lost counting bills).

Also the government heavily incentivizes electronic payments because those can’t be pocketed without paying VAT. That’s a MONUMENTAL amount of tax fraud being chipped at by the progressive disappearance of cash.

That’s the real crux, banks charge businesses to deposit cash. They do it in such a way that there’s no way to escape their ever-increasing fee percentage.

The mattress solution is more and more appealing, imo.

Also the government heavily incentivizes electronic payments because those can’t be pocketed without paying VAT. That’s a MONUMENTAL amount of tax fraud being chipped at by the progressive disappearance of cash.

Unfortunately I think the amount of cash tax fraud that exists is far more reasonable than the amount of straight up fraudulent, yet “legitimate”, expenditure that governments allow. See, for example, covid PPP loans.

Write offs, PPP loans, deferrals, and all the other accounting tricks that the government carved out for the primary benefit of the wealthy are definitely a bigger loss of tax revenue. One guy writing off a personal vehicle for his personal business is probably what a busy restaurant makes in 4 months of cash purchases. Suppliers and distributors are also unlikely to deal with large volumes of cash just as a matter of practicality and risk, and the fact that you can’t have a functioning business with employees that need paychecks without going through banks which go through the government, unless you’re operating with an entirely under the table staff which is just begging for trouble.

Seems like an easy fix for a business, just change their prices so that they don’t have to use coins. Make everything an integer number of dollars. If the items are too cheap to round up, encourage a three for two deal or something like that.

Sales tax doesn’t change that frequently. It’s easy for a business to predict and account for it when setting their prices.

… the euros’ lowest paper bill is 5€. 1 € and 2€ coins are bulky pieces of shit too.

And a bakery is the worst affected kind of business even if there was a 1€ paper bill. A loaf of good bread is 1.40€, if you round up it’s way too expensive and if you round down they may not even make a profit. Can’t exactly buy 3 loaves of bread either unless you got a family of 6 to feed.

Unfortunatley that won’t work, banks charge businesses a percentage for deposits.

The people insisting on using cash are the ones with a big pile of it, with origin dubious to unknown. Anti tax evasion is the best part of digital banking. Threats to privacy is the other side of that coin unfortunately…

Honestly there should be governmental electronic cash with the same advantages as cash, i.e. no fees & no traceability.

there are very easy free bank accounts to open.

Traceability is the tricky part.

The cost of a bank account has nothing to do with fees for electronic cash. Fees for electronic cash are collected per each transaction and are paid by the business you buy from. These huge fees are why businesses are slow to adopt electronic cash in Germany, they see no reason to pay 1%+ of their revenue to Mastercard or Visa or whatever.

You… are not an adult, are you?

Mastercard and VISA are not banks and don’t offer bank accounts.

Bank accounts are free. Transfers to and between banks are free.

That 1% fee you’re talking about is a processing fee from the credit card companies, which are separate financial institutions acting as middlemen to the banks.

There is no need to use their services. You can just transfer bank to bank for free, with free bank accounts. No MasterCard or VISA involved at all.

You… do not know what thread I was replying to, do you?

What is being talked about is high fees associated with each transaction done with electronic cash. Please read the comment I directly responded to again: https://lemm.ee/comment/6705330

It is necessary to use their services (or at least some other entity collecting fees) when you pay without cash in a store. You can’t go to a store and pay with direct bank transfer.

I dunno, there are good arguments for traceability. Bitcoin has complete traceability, up to its endpoints.

Here in at least the state of California (not sure if this is country wide) those bank “convenience” fees are limited to no more than $1.50 by law.

Yes cos California is little Europe and we love the modern thinking

Are you talking credit card fees or bank transaction fees?

That fee charged for simply using your debit card at a POS.

That’s more of a California thing. They’re talking about the fee charged by the CC company to the merchant, which is usually absorbed by the merchant. You’re talking about businesses charging you extra for using your credit card, which I have only seen in California.

I’ve seen it in local businesses in texas

My bank (RBC) charges me $2.50 after 10 or so free transactions, doubled if tapped.

I switched to Neo and I love it.

Re: credit card companies: you’re right, and you’re not the first to say it.

South East Asia is pissed off at them and their fees too. Starting in Thailand (but spreading) their big banks got together and made a QR code system for instant sending of money (similar to what Australia did with PayID which obfuscated bank account numbers with your own phone or email address, and stacked with Osko, a fast transfer system to bypass the slow (days) bank to bank transfers).

You will see street vendors with food carts with a QR code on it. You want to buy something? You order, they say the price, you scan the code, send the money, show your phone, get your food.

(You can have codes with the payment amount already in it, like in a bill, but since this is just a food cart on a sidewalk, they just have one generic “pay me” code)

Because they are bank to bank, it’s all fee-free.

And yes, in the USA you have Venmo and similar, which has other issues, I think.

In the Philippines so many people use pay-as-you-go and prepaid phone plans, and load up their account with credit, they’ve gone further. People could gift credit to other people for a long time. Now, you can actually pay for things with your phone credit there. (GCash, which confused me for a Google product for a while). There’s only two mobile/cellular phone companies in the country (all the rest are resellers), so it has some monopoly issues. But what it means is since everyone has a phone (doesn’t have to be a smart phone. A nokia style dumb phone is fine), you don’t need cash or to pay VISA/MC.

Cash is garbage. Using cash electronically is good.

Using credit card companies is dubious.

If only there was some way of federating spending in a way that would make private credit card companies obsolete. I’m still confused how no one sees any future in block chain and just say “it’s all a scam”.

Block chain has become a buzz word, just like AI or NFT’s, but they sure as hell makes some people a chunk of money before everyone realises what it actually means.

because it doesn’t work. case in point: it hasn’t. It improves on one aspect, and regresses (very very badly) in every single other aspect.

Electronic is faster, more convenient, safer, easier to track, and doesn’t need a stupid purse to carry around.

Haven’t touched cash since 2020, couldn’t be happier.

Very large amount of people end up paying fees from ATMs to get cash. And, if there weren’t card service, you bet the banks would add fees to any type of cash access, eg: all ATMs and bank withdrawals.

thats an american thing, civilized nations dont let banks do that

I’ve never had to pay a fee to withdraw cash from an ATM in the USA, unless it was from a different bank than mine. Other banks charge for the convenience of taking your money from their ATM, when you don’t have an account with their bank or affiliate.

It’s easy to avoid those fees by just going to your own bank’s ATM.

For the record - that’s generally also how it works in Europe. Or well, Germany at least. Also there are independent ATM companies (Euronet and the like) not affiliated with major banks who charge outrageous fees to everyone desperate enough to use one of their ATMs.

I’ve only touched a Euronet ATM to write “SCAM” on it, to warn those unaware of the dangers awaiting them…

Japan does, and it’s actually worse than the US bc the ATM from your own bank charges you if you use it after 5 pm or on the weekend. They also shut down some ATMs at either 5 or 9 pm.

Thats actually insane, wtf japan

Despite the facade, Japan is pretty backwards with technology. The classic way to look at it is a country of duality with bipedal robots and fax machines, although faxes are finally dying out finally. Some examples are that they still produced VCRs until 2016, many places depending where you are didn’t take credit cards up until about 5 years ago (although they seemingly mostly jumped over the credit card thing and went straight from cash to mobile pay systems), and as of 15 years ago I still saw the presence of 3.5" floppies, although those needed to be connected to computers via USB floppy drives.

I live in Europe, and when I withdraw from ATMs when traveling in Germany, I only use “trusted” ATMs like official banks (never Euronet or other “scam” ATMs), but because it’s outside of my own country, it’ll cost ~5€ per withdrawal. In my own country I don’t pay, no matter which bank’s ATM I use.

Other countries don’t have ATM fees, either. I can go to almost any cash point with any bank and withdraw for free. It’s only certain ones that charge, typically places with a captive audience eg festivals or certain retail parks.

The US is incredibly strange for charging people money to get their cash.

ATM fees do make sense if it’s not a bank owned ATM, though. A separate company owns and maintains the machines, which costs money.

Yeah, those are the only ones that might charge. Standalone ones in shops, not at a bank branch, and in particular in places where people might be out drinking.

I’ll just tell you about Japan… they will have “outside of business hours” ATM fees just because. Link to website

With the Postal Bank it is possible to carry around your passbook in place of your debit bank card to access your account. Even from an ATM that automatically records transactions in there which is kind of retro yet cool.

Edit: added link

So some ATMs don’t have fees, and some locations do have fees.

Wow, sounds exactly like how it is in the US, too!

My experience in the US is you pay fees whenever you withdraw from a bank that isn’t your own. In other countries, you don’t pay fees unless you withdraw from an independent machine, and even then many are free.

I dunno though, I had a cushy US bank with no branches of their own, so they didn’t charge fees anywhere. BoA were bastards though, and I’ve heard terrible things about Chase.

Chase has some of the best bank accounts in America.

The bank may be awful, but some of their products are among the best in the world.

I don’t pay them. The business conducting the transaction does :p

You mean, the fee is already baked into the sticker price, so you’re paying it regardless of which payment method you use.

Ya

No thanks

Why the fuck “cash society” is backside? It means they care about privacy.

Not taking cash = backwards.

Not taking digital payments = also backwards.

suggesting crypto?

They’re just suggesting that you should accept both cash and electronic payments.

that sounds weird though. is he suggesting that one should be fed to a tree? eff that.

I’m not responding to that comment?

Get fed right to the joshua trees.

what

Yes

ugh you suggest i should be fed to a tree?

Yes theyre hungry

The post isn’t about privacy, if it was, faxing wouldn’t be on there. I’d wager a strong guess it’s about convenience on one hand while choosing to be inconvenient on the other.

Edit: or maybe it’s more about high tech in some sectors and low tech in others, still not about privacy.

Because a piece of highly debated governance structure, manifest as a piece of technology was put on the “bad” list, (by accedent?) implying the old way is out of date and switching is as much of a “you dont need to think, its just better” (no brainer) as switching your floppy disks and CRTs for USB sticks ano OLEDs. Tech advancing is usually but not a definite good thing.

Why privacy would mean no fax? Fax is mostly more secure than email.

Fax is unencrypted. Encrypted versions apparently exist but that’s not what Japan and Germany use.

And that aside my mom regularly gets sensitive patient data via fax at her workplace because the number is one digit off some doctor’s (bonus points for the inverse also happening, and her also working with sensitive data). Far less likely to happen with email. At most encrypted fax is equally secure.

Most emails are unencrypted. And indeed, in the medical profession, they were widespread. Nothing can protect from the sender putting in the wrong number or email address. I’ve received some seriously sensitive emails not meant for me because the people made typos and the recipients had the same family name as me (not sure how the email server decided it was close enough and delivered them to me).

I’ve also read for some businesses, it was critical to get an instant receipt that the fax has been properly received.

Now, I’m not defending using obsolete fax machines, it just had one advantage over email but today there are much better alternatives and dedicated platforms.

Most emails are unencrypted.

No, they are not. They are not end-to-end encrypted but they are encrypted between your PC and your service provider, between service providers and between service providers and receivers. End-to-end encryption is needed to defend against your service provider or entities that can order your provider around but not against random hackers snooping around in your network.

Fax on the other hand is never encrypted and also not signed, so there is no integrity protection. Fax is far, far less secure than even standard email. Businesses require fax often for legal reasons because laws are written by people with no technical understanding not because of any technical reason.

No, they are not. They are not end-to-end encrypted but they are encrypted between your PC and your service provider, between service providers and between service providers and receivers. End-to-end encryption is needed to defend against your service provider or entities that can order your provider around but not against random hackers snooping around in your network.

This is true AND untrue at the same time! It’s true that most e-mail providers will talk to other e-mail providers with TLS, but it’s trivial to downgrade the connection in most circumstances. If you can man-in-the-middle e-mail servers you can just say “hey, I’m the e-mail provider you’re trying to talk to, I don’t support TLS, talk to me in plain text!” and the senders will probably oblige. There’s a few standards to try to address this problem, like DANE (which actually solves the problem, but is unsupported by all large e-mail providers), and mta-sts which is a much weaker standard (but supported by gmail and outlook). In practice there’s a good chance that your e-mail is reasonably well secured, but it’s absolutely not a guarantee.

That depends on the specific TLS setup. Badly configured TLS 1.2 would allow downgrade attacks, TLS 1.3 would not. I highly doubt the “in most circumstances” line, my guess would be that at least the big ones like gmail don’t allow unsecured communication with their servers at all. If not for their users’s privacy, then at least to combat spam.

It is however point-to-point plus doesn’t go over a public network and the routers of “random” 3rd parties (as IP does not necessarily route your packets always via the same path, and NNTP - the e-mail protocol - is even worse).

Faxing is probably is inherently more private simply because generally there is just 1 company controlling the entire network it travels through (i.e. the phone landline network), though I would hardly call it secure.

Properly encrypted e-mail is more secure with regards to the contents but it leaks metadata (that there was a message of a certain size from a certain sender to a certain receiver at acertain time) to a lot more 3rd parties than a fax would.

doesn’t go over a public network

Your fax just went over public telephone network.

and NNTP - the e-mail protocol - is even worse

Wow, I haven’t seen NNTP in ages. Who still uses newsgroups? And how they even use it for email?

Yeah, you’re right - it’s SMTP not NNTP. Considering that back in the day I used to telnet to port 25 of my uni’s server to send e-mails portraying as one of my teachers to take the piss of my friends and hence knew at least some of the protocol, I must be getting old to confuse the acronyms.

But yeah, the main point is not the network being “public” (in the sense that anybody can access it) it’s that - as I explained but you seemed to have missed - the intermediate hops for an e-mail travelling on the internet can be owned by just about anybody and, worse, not necessarilly in your country working under local laws - routing will often send things around in quite unexpected tours on a physical sense depending on network topology - whilst the nodes the fax data travels on a phone network are generally owned by just 1 company or 2 (the latter in countries with multiple landline providers if you send it from a phone in one to the phone in another, as the network topology is much simpler and all providers connect to each other directly).

If your data goes over at most only 2 networks owned by very specific companies it is inherently safer from eavesdropping that if it goes over an unknown number of networks owned by an unknow number of companies. This is not the same as saying it’s “safe” - it’s just one relative to the other, rather than an endorsment of faxing.

Also there are usually laws around eavesdropping on phone calls, from the old days, whilst it’s the Wild West out there when it comes to those operating intermediate nodes eavesdropping on e-mails.

Frankly, if you can’t send the data encrypted, then faxing is probably safer from a privacy point of view (it would take a crooked telecoms operator risking their license, a Court Order or physical access to eavesdrop on it), but if encrypted e-mail is safer at least content-wise, though as I pointed out plain e-mail with unencrypted headers leaks meta data even if the contents is encrypted.

to send e-mails portraying as one of my teachers to take the piss of my friends and hence knew at least some of the protocol

Nowdays client-server and server-server communication is ecrypted and signed, so no an issue now.

not necessarilly in your country working under local laws

Scary part when they do

fax security is de facto nonexistant

Because phone numbers and plain text.

And money recycling.

Suuuure, “privacy”. Wink wink.

I’m a criminal! Wank wank, nudge nudge

Not necessarily. It might be privacy but it could also be a combination of other reasons too - a cultural aversion to paperless transactions, a lack regulation for electronic payments, lack of a decent indigenous payment system, lack of financial safeguards, prevalence of fraud / skimming devices etc.

Some European countries were more into electronic transactions than others but with stuff like SEPA, chip & PIN, contactless payments I think most people are just fine using electronic payment unless they have reason to control the transaction in some way. For example I usually pay pretty much everything electronically but I still pay taxis and most restaurants with cash. Also tradesmen if they’ll give me a discount for cash.

I used to work in a shop when I was younger, and the older generation always asked for “cash discount”. Why on earth would we do that, my boss said to me. We need the money to be in the shop’s bank account, not laying around somewhere and not being used.

I remember carrying several 100k of our money, late at night, to our banks night safe and drop it in. That sucked. And they charged us for this too

Cash is off the books so there is an incentive for certain kinds of businesses like tradesmen to take cash because it still works out cheaper since they don’t have to declare it to the taxman.

deleted by creator

Question: do the Japanese actually care about privacy? I know I do, but if you were to ask a Japanese person why does their country use cash, would they say “We have considered a system of payment cards and decided against it for privacy reasons” or would they just shrug and say “I dunno, I’m not in charge of payment systems, I use what I have”?

Cash is traceable in most countries for decades now. Cash doesn’t mean privacy.

When I found out about all that I was honestly kinda glad my country, Germany, isn’t the only one that’s in the past in terms of bureaucracy and digitalization of services.

But cash is a weird point to add. A society without cash would kinda be dystopian ngl

Without cash, you can’t have privacy. All card or contactless payments are logged and probably sold to advertisers or anyone with enough cash who wants that info.

Very true. But those advertisers and data brokers (and governments) have convinced most people that the convenience is worth it, and that only criminals desire that level of privacy.

They can’t stop me from using cash if I want to though. It is legal tender for all debts, public and private.

Debts, yes. But businesses don’t have to accept cash if you pay before the service is rendered or the product is purchased.

Businesses in the USA, especially regions with a higher proportion of black or hispanic residents, will go out of business if they stop accepting cash. It’s not going to happen.

It is legal tender, but you can’t force people to accept cash in their own businesses. Before you walk into a store, they can say we do not accept cash. By walking in and buying, you agree to not use cash

Yeah but that doesn’t happen. Cash payment is the default standard that backs up the other forms of payment that depend on Internet / phone infrastructure and electricity.

No business that I have ever patronized has refused cash, but many have been cash only and were not able to accept cards or contactless payment. Power outages, Internet outages, etc all can bring down payment systems’ infrastructure.

That’s how it is in the USA, and it’s a good system. Cash is reliable and puts the entire monetary purchasing power into the literal hand of the citizens, versus cards and other digital payment systems that can be controlled by authorities to deny your access to your own money.

It does around here (Norway). I’ve never even seen how our cash looks like since the late 00s.

The US is a shit system made for fucking the average tax player in the ass

Sounds like you don’t know what you’re talking about. This all works fine in the USA for us, it’s not a bad system at all.

I have ALL options available to me - cards, contactless payment, cash, credit, whatever. I celebrate the fact that cash is an option that lets me avoid having every data-hoarding entity collect records of my purchases.

Taxes aren’t fucking me anywhere, I pay them and I get government services and infrastructure in return. Taxes aren’t hurting me at all in fact.

I’m an immigrant in Germany and kind of had to laugh at this, because the cash thing is so hard for foreigners here. Since the pandemic it’s been better, but I had multiple moments before it where a grocery store or gas station only accepted cash with zero warning.

I didn’t like having much cash on me at first, because I was worried about losing it or having stolen. After about a year, I did lose my wallet, but the found things bureau at town hall called me to return it, cash still inside it. They charged 10% (iirc) and split it wiith the person who found it.

Edit: name of town hall changed for clarity

I’m currently in Scotland and have experienced the exact opposite xd I was kinda shocked when certain shops and stalls at festivals only offered card payment. Like just a few days ago I went into town and saw that the Christmas market was already up and running so I thought I might as well buy myself a mulled wine. At the stall I realized I didn’t have that much cash on me (especially since mulled wine is extremely expensive in Scotland for some reason. Borderline scam lol) and asked if card payment would be okay thinking they would refuse since it’s just a stall on a Christmas market so why would they be able to accept card payments right? The clerk answered “Oh yeah we only accept card anyway”. I was kinda shocked a bit but I got my mulled wine so all’s good :D

Why should the town charge you?

They provide a service, why wouldn’t they? As a student, I didn’t pay any taxes, but I still benefit from the service. If I had had my rent payment in the wallet or hadn’t been able to afford it, I might have tried to cap it, but it was like 60€ total (for a payment of 6€, not a payment of 60€), so I wasn’t bothered.

Because its a public service funded by taxes? Ok now I understand if you didnt pay any

I’m not sure if it’s partially funded by taxes or just the profit from the found things, because I’ve only dealt with them the once. I’d assume it’s at least partially funded by taxes, because they’d need to find a lot of lost things otherwise. I don’t know if a taxpayer still has to pay a fee, but I suspect so, based on how things generally work here (though they’re also generally sympathetic, in the case that someone does have their rent or something that they can’t afford to pay in the wallet, though there probably is a cap on how much someone would have to pay).

I think of it basically as a deductible for the lost item insurance.

Edit: I realized the problem. The found things bureau called me, I just felt like that was a weird translation so said town hall. Sorry lol

Cash society is a bad thing since when

Psyop to make people think that electronic is superior.

Since forever.

Most of those negatives sound fine to me.

Yeah, like what’s wrong with cash?

America doesn’t really have a functional system for this yet either. It’s a lot easier to just tap your phone on a brick and be done with it, but currently the tap method is pretty hit or miss. And bank transfers are atrocious - why do we pay venmo to do something that Korean banks just straight up do for everyone? In Korea you can just give someone your deposit number and with a couple buttons you send money easily/instantly.

You don’t even have to go that far, Canada has interac e-transfers where you can send money by email. Directly accessible through the standard bank app/site. I haven’t handled cash in years

Ew email does not sound like the place for cash transactions.

But yeah, most countries these days have instant bank transfers. The US is ancient when it comes to payments, “cashing your payslip” isn’t a thing in much of the rest of the world.

In Australia you can send money via phone number or email (called payid) but it’s not sent in an email or SMS, it’s just that your number/email address is used as a unique identifier linked to your bank account. When someone pays you via either of those, the money gets directed into that account instantly.

And yes, being paid directly into your bank account is standard here and I would say really the only option for most jobs. I’m 35 and have never had a job that doesn’t pay you direct to your account.

They likely mean their bank uses email as an identifier. So the bank asks you the registered email you’d like to send money to. Not that you’re emailing cash or something like that.

Similar to zelle, a third party that fills the gap.

The email is like an id for your account. You can use your phone number. AFAIK if you link it email or phone number to your bank and someone sends you money to that email or phone number it doesn’t actually text or email you. The money will be directly deposited into your account.

In Australia you can send money bank to bank for free, with practically instant transfers (though large amounts and first transfers from you to someone get a 24hr hold)

And you can use the person’s phone number as the transaction target (instead of bank branch number and account number)

It’s pretty nice, good for small business too, especially trades

Re: Australia: be aware that all normal bank to bank transfers are still min 1 working day transfer. Its FAST and Osko which bypass that with their own new network (up to $1000).

Not every bank is with Osko or FAST, and some are with one and not the other. Though I think FAST is fading away with Osko being dominant.

Re: phone number: or email address! It’s great, especially if you have your own domain name. You can make different PayID email addresses for each account you have if you want.

Me and my mate have sent money to each other for kitty balancing on fishing trips, this year (about an hour ago) he sent me his share (high hundreds) and it was instant

We don’t use phone number since we have had each other’s bank details for ages

Osko/FAST: are fast BSB/Acct# transfers.

PayID: is an easy way to reference a BSB/Acct#.

Together, they are fast and easy, but they are not the same thing and are not required for one to be used to use the other.

Also, “high hundreds” is less than $1000 :-P

Theoretically the situation with bank to bank money transfers should be improving - the replacement for the ancient, slow ACH system went live a few months ago. Of course it will likely take several centuries for a critical mass of banks to support it, but there has been some progress at least.

Same in Brazil, i can send i think 10k to anyone in my contact using PIX that was created by the goverment and is opensource, i can pay with it too, there is other way too, but PIX is the easier, just need a internet connection

you can send using ramdom nunber, cellphone number, CPF, qr code, email, just need to configure the key that you want in you bank or bank app, and it just work without fees

I don’t know much about Korea. Do they have laws limiting how much you can be tracked and marketed to?

My bank still sends me a text message and has no other means of 2FA options.

You’d think they’d be way more up to date on this “digital security practices” stuff. :|

I have a really slim wallet, which is only possible because I never have to use cash. Also cash is dirty. I can wash my phone once a week to keep it clean but I can’t do that with cash (well I can but what’s the point, and I’ll get accused of money laundering /j). It’s inefficient since you have to count your coins and bills and the cashier needs to do the same and then you have to check if you got the right change. You can also misplace cash, especially coins.

Meanwhile I haven’t had to handle cash for like 6 years now except for extremely rare circumstances and it just feels way better.

It’s not even accurate anymore. Cards are accepted in a lot of places.

It was absolutely true 10 years ago, though. It’s inconvenient always needing to think about how much cash you need to bring, and having a pocket full of change because it’s significant denominations.

Also, their banks are only open on weekdays and close super early. Bank lines were (are?) massive because everyone had to go at the same time due to work hours.

Annoying to deal with

…how? The only acceptable one (Even though I personally don’t like it) is cash.

Fax sucks ass and should have been put in the grave LONG ago, Flash drives are superior to Floppy in every way and fuck paper filing, digitized paperwork is far superior.

If people actually upgraded from FAX, I would have completely agreed. What we have today is an abomination which doesn’t work. Not even a week ago I had an issue with some paperwork where tax office required me to fill some form in PDF, then print it, then sign it, scan it and send it to them. I have a phone with a pen, so I did all of that and skipped few steps. Signed the document on screen. No no no no no. They didn’t want that. They want my signature on paper which I never have to send them but my signature signed through screen is not good enough.

FAX is basically all of this with fewer steps and I can easily see why they wouldn’t want to move away from it. It it works, don’t fix it mentality. Luckily this trend is slowly going away, but damn. Not to mention same IRS office required me to generate a certificate which I can use to digitally sign documents. But I couldn’t do this either, since they accept that only on some documents. A mystery.

As far as floppy disks are concerned, this is mainly for industrial machines. They are still a huge user. Those machines are not replaced every 2 years as they are more robust and made to last. So having a machine older than 30 years still working in industry is nothing new and considering upgrade costs literally millions, it’s simply not worth paying that much money to upgrade to USB.

Lots of those floppy drives in industrial and lab applications (as well as the retro computing enthusiast space) are being replaced by things like GoTek devices, which are essentially floppy emulators with flash memory.

In some places, yes. But many are still not doing the upgrade as it would require technical person to do so, provide tech support, etc. All of that costs money. Whole industry is becoming very specialized place. Siemens still sells laptops with DB9 and other serial connectors just so you can access and program PLCs. And new USB based adapters to serial simply don’t work. Sometimes they do, but most of the time they have issues with these specialized devices.

Floppy drives are the brontosaurus among these, excusive paper filing sucks too, but cash society and fax telecom is not that bad.

I mean these things can’t be that bad, Japan compete well on the world stage so whatever they’re doing is working fine. Can it be improved, probably. Does it need to be? Not yet

-

We use fax in the USA more than you’d think. I’d call that a wash.

-

Paper in your filing cabinet will never be messed with by a ransomware attack. Ransomware attacks seem to happen to businesses and hospitals just about daily here. I’m actually watching a news story on a hospital ransomware attack as I write this.

Floppy drives? Yeesh that one is a bit weird.

-

Yeah honestly living there for a while, I came around a bit on doing things by paper.

It’s slower, certainly. But the Japanese are scary efficient at it, and there is a lot of infrastructure to support it.

And in the case where things go wrong or are confusing, at least you can take the forms and actually go and talk to someone, rather than staring at a computer screen that offers nothing.

I think someday we will look back and consider if taking everything digital was ever the right choice. Friend always uses the term, “high tech downgrade.” The more I interact with the internet the more I learn how it pushes the limits of our society in not so great directions.

Germany is the same but without the bullet trains and the robots wiping your ass.

we have plenty of bullet trains - 367 last I checked, plus bullet trains from other countries - they’re just chronically late because of car-focused policies over the last decades causing the infrastructure to basically rot away.

still no ass-wiping robots though, maybe one day…

yeah we have a bunch of ICEs, but no transrapid for us. japan has a bunch of maglev trains.

Japan has one maglev line under construction with a completion date set for 2045.

deleted by creator

deleted by creator

Well, also plus random homeless guy yelling at you about Vladimir Lenin, the roads looking like Romania ca. 1983 and a cadre of stern government employees showing up out of nowhere to shout “NEIN!!” and disappear. Very futuristic in a sort of Metro 2033 way.

As a Romanian, that would be overestimating our ability to maintain roads.

Roads? Where we’re going we won’t NEED roads!

It’s Romania, we’re going to Romania.

Yeah, when I think of Germany, I think of papers.

Germany doesn’t have bidets? France does.

Bidet as it may

Guess I’m the only one in the thread that hates cash. It’s filthy and messy. Much better to just beep my watch and move along

Everyone who is saying there is nothing wrong with cash is right. However, there is one major drawback to cash which is no longer a big problem in societies which are mostly cashless. Namely, if your wallet gets stolen and you have $300 in it, you’ve lost that $300 forever. If your wallet gets stolen and they get your cards, you can just cancel them and aren’t even charged for fraudulent purchases.

I realize that means less privacy, but I can’t afford to lose that kind of money just walking to the supermarket to buy groceries.

They solved that problem by having no thieves lol

I was just in Japan and how safe it was blew my mind.

This sentence makes me laugh. Where are you from?

Probably Detroit

Argentina, unfortunately.

For me, the main drawback is rather than you need to get to a machine to get your physical money pieces regularly. Sometimes you run out, there’s no machine, or you have no time to find one, and it can put you in troubles, like being stuck in the middle of transit or getting at the cashier and realizing you don’t have enough.

Your in a cash+card hybrid country, right? In my country at least, you can go into a chain grocery store, buy somthing (doesnt matter what) and pull a small to medium amount of cash from your card. They are (slowly as to not alert people) trying to tear that system down and go cashless.

Before I kind of blundered unintentionally into going mostly cashless, I’d just get cash out when I went grocery shopping. But thankfully by the time I was in charge of my own money it was pretty rare to need to spend money without the option of paying via EFTPOS.

Thanks for teaching me the abbreviation EFTPOS.

Welcome :)

It was pretty common to hear people talk about it for a span of about 10-20 years in Australia. For as long as I can remember every bank gave you a card that was not a “true” credit or debit card, but would work in the EFTPOS machines of any domestic store. They were called Redicards, and were basically debit cards you couldn’t use online (once internet shopping became a thing), but worked in ATMs, stores etc. Even back in the 00s it was rare to see someone pulling out a cheque book to pay for anything, and now it’s basically unheard of. Talking to US friends I get the impression Australia beat them to this level of wide-spread electronic payments, by quite a margin.

This year the Redicard network is shutting down and I just got issued a second Visa debit card by my bank to replace it. End of an era…

Valid point. But I assure you if you lose your wallet in Japan with $300 in it (because, statistically, nobody will steal your wallet), you’ll find it at the police station next day.

(That’s the most statistical thing that can happen, please do not try.)

Went there on vacation recently and my girlfriend left her luggage in an elevator and forgot it for 15 minutes. It was at the police box a block over.

Finally a positive post on Lemmy!

I had my wallet stolen years ago, within an hour someone had purchased thousands of $$$ worth of MacBook pros from the Apple store.

Don’t lose your debit card!!! The bank doesn’t do charge backs!

how?

they would need a pin for that, for contactless payment there is a limit, I believe 200 euros in my country.

so did you write your pin down on a paper and put it in your wallet or do you have your money stored at a terrible bank?

I don’t know about elsewhere, but in the US you can run a debit card as a credit card without needing the pin. Pin is only required for cash back.

You also won’t have that money to spend if the power goes out.

Manual credit card machines have existed long before electronic ones.

That’s just absurd. Who the hell has one anymore? Not to mention they require the card to be embossed and not all are anymore.

You can literally write down the number on a piece of paper and a price and let the bank know or enter it manually when the power goes back on. This simply isn’t a problem unless society collapses and if that happens, cash will be worthless too.

I’ve worked in multiple retail stores and not a single one of them would do that. If the power went out, they lock the door. So that absolutely doesn’t work in the short term.

Long term? Idk, how long can you hold out w/o spending money?

deleted by creator

If the power goes out on a global scale, you won’t be able to spend cash either.

Wallet in a cashless society? Are you stuck in the early 2000’s?

Now, cashless means Phones+NFC, which means when your wallet, a.k.a your phone, gets stolen you get taken somewhere until you allow access to your phone and banking apps where there should be an easy 10~30k in savings + loans they can extract

GG

People have savings? Sounds like the 90s.

You think people don’t have and use credit and debit cards anymore? Really?

“Taking you somewhere” is far too much effort. They can just watch you enter your passcode on your phone in a bar, then swipe your phone from you and gain access to all your accounts.

Biometrics are good for some things.

Yeah, for getting kidnapped 🤣

Where you getting the 10k figure, and how many people do you know who would have thay on hand.

Here in Brazil most better-off people have access to that in easy-to-contract loans in banking apps like Nubank, etc

This scenario is of course impossible if you only carry cards or money 🤷

/s

Banking app access ransom isn’t the same as the good old ransom family for money, the risk/reward ratio is so much better

im gonna press X to doubt that you carry $300 to the grocery store, let alone that you carry that much groceries by hand while walking home

Yeah homie I dunno there. I’m in Quebec right now and it’s extremely rare for me to get out of even a simple grocery run for less than $200. I could easily carry home 300 dollars worth of groceries, even buying mostly generics.

$300 is not at all unusual for groceries these days if you have a family.

It is not hard to rack up $300 in groceries where I live. I’m lucky to walk out w/o spending at least $100 for my smaller trips.

And that’s just for me.

$100 is my weekly beer bill.

You put paper filing and cash society on the “bad” list. It’s like it’s wrong for people without an internet connection or privacy conscious people to file stuff. “Pls use our brand-spanking new web UI that loads a shit ton of Javascript and steals your data on top of it!” Oh and cash society. No, why would anyone want to pay in a privacy-conscious way. Naw man, pay with a card…

With a way less harsh tone, I agree with your first point. Credit cards magical for the user but are full of deamons that they cant see just by using it. I’d prefer a cash only society to one where a private company controlls all access to money. Hybrid is alright but makes the situation maluable (in my country, because of the card, some compamies will make it hard or refuse to take legal tender).

“Pls use our brand-spanking new web UI that loads a shit ton of Javascript and steals your data on top of it!”

You derailed your point, biggest thing you can do right now is use ublock or noscript. Pull as much money as you need in cash and live off of it instead of using your card.

It’s not about having the option, I love having alternatives. It’s about 90s ways being the only choice when they could have better options. E.g. You need to send a form. It’s already a pdf file, send it by email, right? No, it has to be physical mail… or fax if they have a number. Oh, and you have to stamp on it. No pdf. Multiply that by time constraints and local bureaucracy mixed in.

Oh, another fan of living in a stone age.

It’s a downgrade if you can’t choose the stone age way. And with things like physical cash that downgrade is pretty bad. I don’t want a record of the 15€ my friend gave me for stealing the bathroom key last time we were at McDonald’s.

Cash is traceable for decades now. Don’t worry, everyone knows what you’re doing.

As someone who filled out multiple copies of the same contract by hand to buy a house recently, which had to be stamped with my seal and not signed, AHHHHHHHHHHghgghhg. On average, I only have to fax something once every several years. NTT, the main telecoms provider, STILL requires that you fax paperwork to get internet (at least for NTT East as of two years ago).

Using cash is great (except for my airline miles account), but one of the biggest banks in Japan is notorious for outages. ATMs here also, until very recently, had business days and hours. That’s finally mostly gone, at least. They can still run out of money at the year-end holiday season as everyone is home with family and they’re not always restocked in some locations, but more ATMs also helped to solve this. The problem with things transitioning to electronic payment is also those payment processors take a cut. We have all kinds of payment apps here, but many small businesses I know hate using it. The ones I know that use it most generally have larger foreign customer bases (anecdotal to business owners I know; may not be generally true in all of Tokyo/Japan).

I take pity on Japan as the only nation on Earth to fully internalize grind culture as their source of existential meaning to an even more toxic degree than the United States.

If they didn’t exist, I probably would deem such a thing unsustainably improbable, but there it is.

To be clear, I’m not referring to places where the poor are exploited to work even longer hours at more physically brutal jobs for basic survival, I’m talking about self proclaimed “developed” nations whose citizens are indoctrinated to proudly jump into the productivity volcano as some kind of honor/life’s purpose/sense of identity in itself, and who wouldn’t have it any other way.

South Korea is more the first case than the second, no?

Completely fair.

That said, when there was a proposal to increase standard work hours in South Korea recently, the people rejected it loudly. There is a desire in SK by many to achieve work life balance, which would be something of a slur in Japan.

Everything I’ve ever seen of Japanese culture would indicate so much as speaking against something like that would get you ostracized by the vast majority.

I’m not from the original “developed” nations but imo occupation is a pretty big factor in one’s identity.

As a German -Homer disappears in hedge

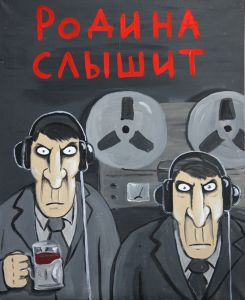

We only have a bit of the first panel (technology wise) and all of the bottom one

What’s bad about cash?